Today I divested my cryptocurrency holdings

by Brad Hines 11-29-17, 4:06 pm

Today was the day I took my gain and divested myself of 85% or so of my cryptocurrency holdings. I am by no means trying to call a top, instead I am being strategic and taking the gain that's there many of us never thought we'd see this fast to begin with, and I will continue to partake but with a significantly reduced exposure. As a follow-on to a post a few days ago likening cryptocurrency & blockchain to the 1st and 2nd wave of the Internet, I can no longer not take gains on these kind of crazy upswings-for-nothing. It is now time to sideline, and watch what happens for the next few years...or at least months. I like to think that entrepreneurs and VC will fill the vacuum building out ways for us to use crypto/blockchain/smart contracts, just like after the dot-com crash in '99, when eventually tech entrepreneurs got the valuations to where we'd initially speculated when we were all green about it.

I believe in cryptocurrencies. I believe in blockchain, smart contracts, and other applications of the underlying technology. But I want to wait for a maturation process. If you ask the average holder of a cryptocurrency like Bitcoin how many times they have spent it, or if they have found it easy to spend, the answers are typically telling.

While most of my holdings were not in Bitcoin, many of the so-called altcoins are coupled with it. So it is, the underlying usage of these currencies is not there right now to properly reflect the underlying prices. Instead, it is seemingly just too many individuals and groups, including institutional money, engaging in "FOMO". That is not a good strategy of course for investing, nor is it–it's speculating. At the risk of a cliché, people who understand the Dutch tulip bubble can liken it to this. So it is not to say the valuation won't be justified in hindsight down the road, nor going higher, it is to say, right now it seems too much too soon. There are too many currencies, and I don't have any special information to forsee which will be the mainly adopted one(s) when the dust settles.

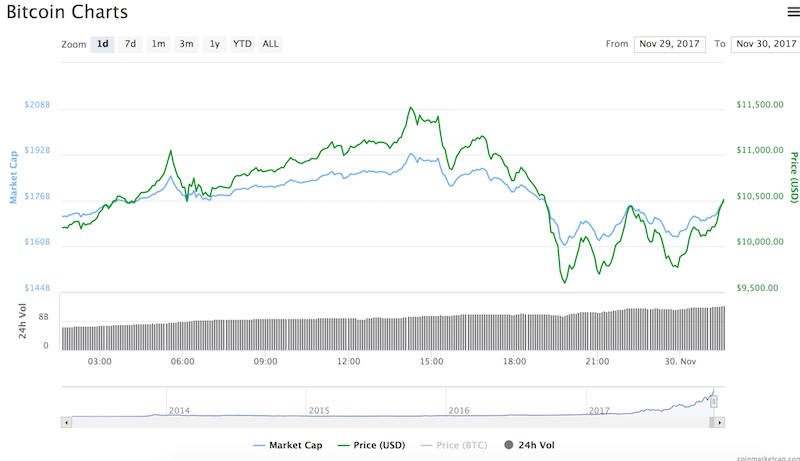

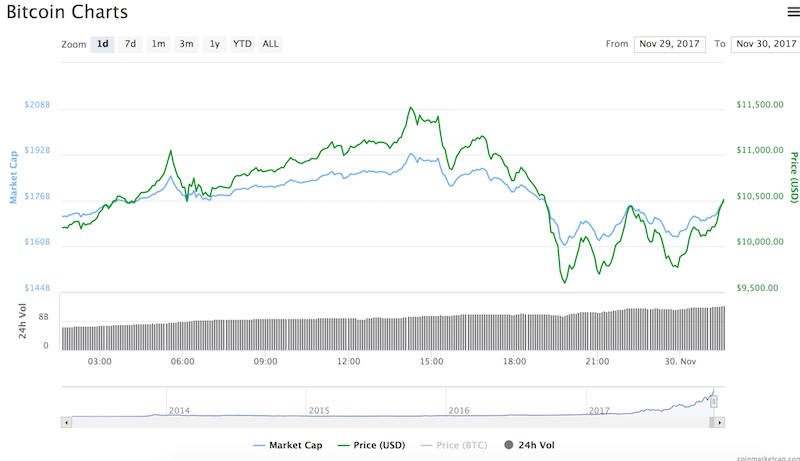

$10,000 per BTC, a figure getting published everywhere in the last 24 hours, is a psychological price point where a lot of holders were intending to get out as I did, despite it being an arbitrary figure of course. Indeed, selling was a bloodbath as the price for a single bitcoin fluctuated as much as 15% today.

A few people have asked me lately my thoughts on whether or not to buy-in now. I would say do not, or do so with extremely little money. Rather than beat yourself up about missing out (at least you're not the guy in 2010 that bought two pizzas with bitcoin that would now be worth $100million dollars), think of other ways to partake. To borrow the analogy of "getting rich selling picks and axes during the goldrush", there a lot of other ways to profit from cryptocurrency and blockchain rather than buy and hold, something I no longer can endorse with confidence as I did in the springtime. You can invest in companies that benefit from it, you can make a vlog about crypto, an information product, create a startup in the space, etc. But please please, don't be like the guy who sold his house to buy bitcoin. If you insist on purchasing a stake, maybe wait until a pullback, or purchase in small quantities, progressively, and with "play" money.

*I'm not an investment advisor and please do your own due diligence.

Have a thought? Leave it in the comments below.